INSTANT MARKET ACCESS

Trayport®’s Automated Trading (AT) lets you run additional execution strategies with Joule®, ensuring you are as close to the market as possible. Automated Trading can help you act faster in the market, giving yourself a competitive advantage in order to capture the best price.

New Feature

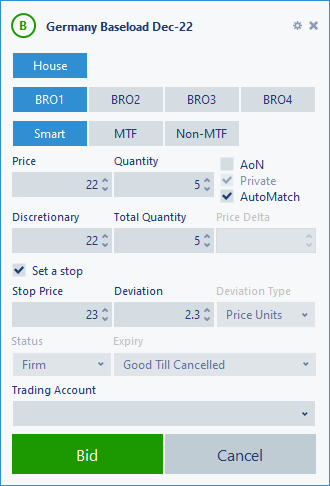

Stop Orders

Observe market price movements and automatically place an order, once a predefined price point is reached without monitoring prices manually. Effective in highly volatile markets, Stop Orders allow you to protect your gain and limit possible losses.

Stop Orders are not visible to the rest of the market and remain hidden until a trade occurs on the market at the predefined stop price

Order Execution Strategies

Ghost

Hidden order, seen only by your company, monitors market and executes when price is available.

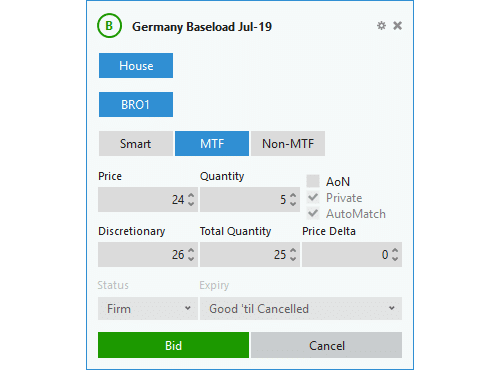

Discretionary

Shows the market an order level whilst allowing you to aggress at a pre-defined discretionary price that remains hidden from the marketplace if a matching order becomes available.

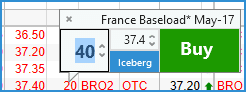

Iceberg

Submit fragment of total order to market, with the ability to automatically aggress volume at the same or better price on the opposite side of the market. Total quantity of order is hidden from the marketplace.

Iceberg Discretionary

Combines features of both Iceberg and Discretionary orders into a single order, allowing you to add Discretionary orders with a private hidden quantity.

Flexible Order Management

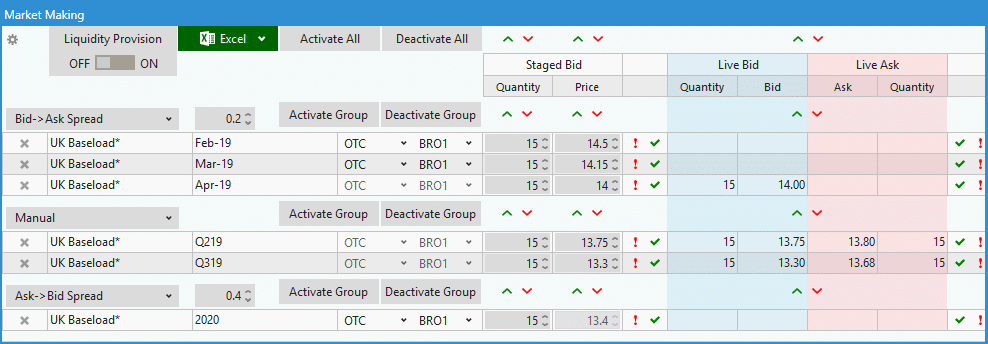

Market Making

Quickly and easily manage groups of orders with a single click on any venue. Links to Excel in order to calculate prices and quantities for your orders. Helps meet Market Making obligations by allowing you to enforce a fixed bid-ask spread. Tracks your daily position in Excel on orders traded through the Market Making tool.

Spread Maker

Trade a standard or bespoke spread without being transparent. Submit synthetic spread orders to market based on a given tick differential off another contract. Have the ability to simply quote or auto execute the balancing leg and import prices from Excel.

Swift Order Execution

Power Sweep

Power Sweep can be used to quickly deal multiple orders in a single stack. It is similar to Deal Volume, however all orders placed using Power Sweep are either Ghost orders or Iceberg orders. This means that Power Sweep orders wait for any hidden volume at the better price, before dealing volume further down the stack.