15+ gas markets incl. TTF, NBP & CME (HH)

Global Gas Screen

View best available prices

Arbitrage opportunities

Optimise Your Trading

Trade Gas With Joule

Trayport’s trading solution, Joule, enables access to over 15+ physical and financial wholesale gas markets including TTF, NBP and CME (Henry Hub). Utilities, banks, funds and industrial consumers use our platform to trade derivatives in multiple European gas markets through multiple brokers and exchanges, and now in North America as well.

We have become a leading solution for trading gas due to the value Joule provides in execution and capturing the best available prices, but also because Joule helps traders in spotting arbitrage opportunities between different markets, time periods and virtual trading points with supported venues.

Best Price Discovery

The Global Gas Market In One Screen

Our comprehensive network is why Joule is seen as the Global Gas Screen.

Liquidity within the gas market is spread across multiple venues with Joule allowing all orders from the different order books to be displayed in a single display – facilitating best price execution in a single workflow.

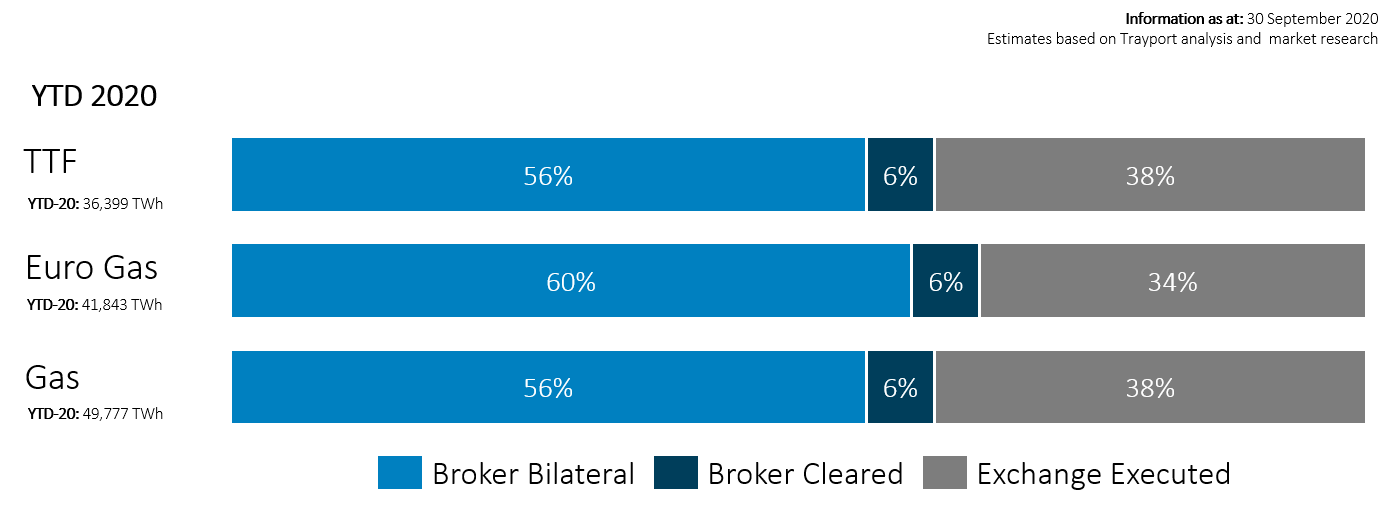

Estimates based on Trayport analysis and market research.

Unparalleled Access

Market Liquidity

Unparalled access to the orderbooks of the below venues within a single unified Joule screen, trading under your own credit or via Energy Market Access (EMA). Access to Trayport’s Joule screen allows traders to undertake analysis of order and trade history to recognize

trading opportunities.

Brokers

- 42 Financial

- BGC Partners

- CMD

- Evolution

- GFI

- Griffin Markets

- ICAP

- Marex Spectron

- OTCex

- Tradition

- Tullett Prebon

Exchanges

- CEEGEX

- CME GROUP

- EEX Spot (inc CEGH & GPN)

- GME

- HUDEX

- ICE ENDEX

- ICE Futures Europe

- MIBGAS

- OMIP

- OPCOM

- PXE

Clearing Houses

- CME Clearport

- ECC

- HUDEX

- ICE Clear Europe

- OMIClear

- BME Clearing

EMA

- Axpo Solutions AG

- Citigroup Global Markets Ltd

- Macquarie Bank Limited

- Mercuria

- RWE Supply & Trading

- Vattenfall Energy Trading

OPPORTUNITIES IN AN ACTIVE MARKET

Trade the best bid/offer

View the aggregation of over 10 physical Brokered markets alongside comparable financial contracts from 3 exchanges ensuring the tightest bid/offer spread for the benchmark TTF contract.

TTF Basis Market

Access to trading the full European gas market across all countries as a specific contract or as a basis against TTF prices, including significant LNG destination markets such as UK and Spain.

The Complete Curve

Offers access to the physical spot and prompt markets for immediate delivery through to longer dated months, quarters, seasons and yearly contracts listed as futures and forwards. Trade time spreads generated from the best prices available.

Depth of Liquidity

Access and trade the deep European liquidity pool provided by the physical participants alongside the US and Asian benchmark gas contracts.