DATA ANALYTICS

Utilise Joule’s sophisticated analytics tools and features.

Data Analytics was built to support our trading clients, with a suite of sophisticated tools and features purpose-built for the energy markets. Utilise analytics tools to generate insights, spot trends, risks and opportunities to enhance your trading decisions. Develop powerful models and algorithms using the new Analytics API.

ENHANCE YOUR TRADING DECISIONS

Core Analytics

With Data Analytics, data from all venues connected to your Joule Direct company is normalised and stored securely along with your own trade and order information. This data is accessible via Joule Analytics, the Analytics API and the Market Abuse Regulation (MAR) file.

Joule Analytics

Access a suite of analytics tools seamlessly integrated within Joule to help traders and analysts validate market opportunities and strategies.

With Joule Analytics you gain access to the following features from the Joule screen:

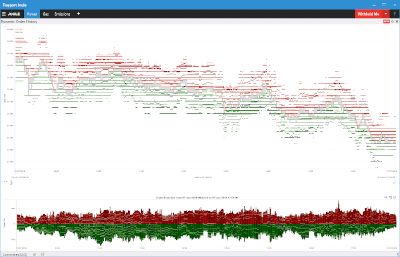

Reconstructed Order Book

Select and view a contract to explore historic bid/ask order data over time, view bid/ask spread or include further price levels from the order book. Market activity can be charted over a specific time range or view a snapshot of the order book at any given point in time.

Advanced trade query

Traders can request historic market trades within Joule, filter based on a specific market or product and quickly export to Excel or clipboard.

DEVELOP POWERFUL MODELS AND ALGORITHMS

Analytics API

A quick and powerful tool for integrating historic data queries from Data Analytics into your own models, algorithms and strategies. Specifically designed to be platform and language agnostic – this REST based API can be implemented within python (and a number of other programming languages) with just a few lines of code reducing time and cost when compared to implementing a bespoke data warehouse solution.

The Analytics API will provide the following functionality with further enhancements planned in the future:

- Querying best bid/ask prices for custom time

and interval ranges - Query full order book for custom time and

interval ranges - Querying OHLCV for custom time and interval

ranges of individual or commingled contracts - Query market trade data for custom time range

- Query for order book events over custom time

range

USE CASE: ALGO AND STRATEGIC DEVELOPMENT

Data Analytics allows you to programmatically access data at different levels of complexity providing an effective mechanism for developing models and trading algorithms.

1. Simple Modelling

Use Joule Analytics advanced trades query to retrieve trades from a specified time range. Look back beyond the default window provided by Joule. Export as a CSV file and use to build models in excel or other applications. From this point begin to develop a simple model or test a hypothesis for a trading strategy.

2. Model/Algo PoC

Use the Analytics API (with easy support for common data-friendly programming languages such as Python) to take your model or algo to the next step. Easily query for aggregated data (OHLCV) for trades and best bid/ask for orders over custom time intervals.

3. Historic Testing

Once you have written an implementation of the Algo, use Data Analytics to source trade and order event data and evaluate the model efficiency.

Use of the Data Analytics product is subject to contract & relevant permissions.