The race to reduce carbon emissions around the planet requires multiple tools from technology to market solutions. The voluntary carbon markets are rapidly becoming a growing piece of the answer.

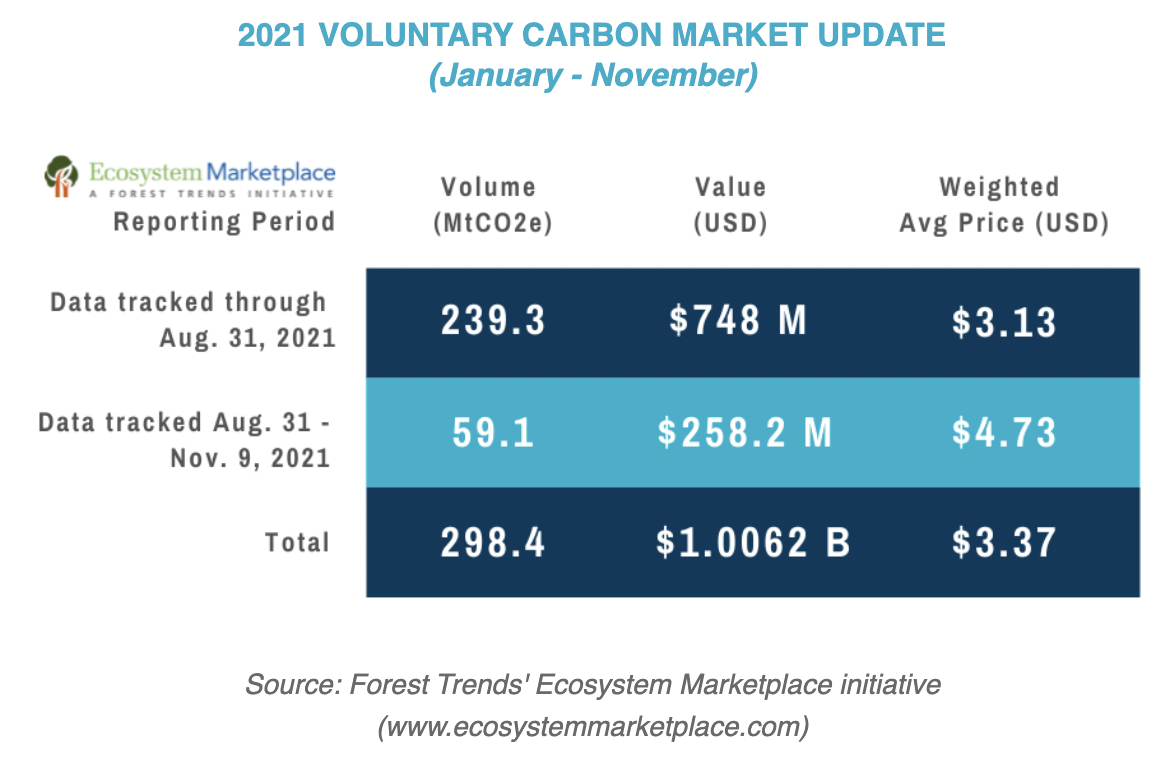

In 2021, voluntary carbon markets topped $1 billion dollars in notional value, according to Ecosystem Marketplace. This is driven largely by the 7,500-plus companies that have declared Net Zero goals by 2050 or before with the United Nations campaign, plus many more that have announced their own pledges. Some of this comes from corporate sustainability ambitions while others are feeling the pressure of shareholders and regulators to lower emissions and disclose climate risks. As such, companies will need to lower emissions from their operations and utilise voluntary carbon offsets to meet those objectives.

While the voluntary market today is poised for rapid growth, it is still a fraction of the size of the North American and European compliance carbon markets – which traded more than $1 trillion in notional value in 2021, based on statistics from the European Energy Exchange, Nodal Exchange and Intercontinental Exchange. The recent growth trajectory of global compliance markets has been substantial, as more financial players have engaged with these markets and a growing number of countries are implementing compliance emissions trading systems.

The voluntary markets were the first carbon markets, with the establishment of the Chicago Climate Exchange (CCX) in 2003, which set the standard and evolved into the compliance carbon markets we see today. While voluntary markets have been around since, they have been fragmented, largely bilateral and opaque, which has hamstrung its growth.

The Voluntary Climate Marketplace (TVCM)

The renewed interest and demand for voluntary carbon offsets has spurred new and innovative marketplaces with efficient ways to access and trade them.

The Voluntary Climate Marketplace (TVCM) operated by IncubEx and available on Trayports’s Joule electronic trading platform, was forged to bring transparent pricing and more efficient trading processes to the growing base of stakeholders looking to achieve net zero commitments globally.

This marketplace enables participants to place live bids and offers on offset projects from five of the top voluntary carbon registries (i.e. standards), each recognised by the International Carbon Reduction and Offset Alliance (ICROA). TVCM is also an independent venue. In other words, it is a neutral marketplace that allows buyers and sellers to meet with transparency on price and information on offset projects.

For IncubEx, whose founders and key executives helped build CCX, TVCM is a return to its roots and an opportunity to build an even more robust market. For Trayport, TVCM is offered on a globally accessed trading platform for energys, compliance carbon and voluntary environmental markets. The ability of Trayport to aggregate disparate markets is one of its greatest value propositions.

With access to existing compliance carbon markets on Joule, traders are now able to obtain a global view of compliance and voluntary environmental markets on one platform. That includes European carbon EUA futures traded on multiple exchanges, North American carbon futures, a broad range of Renewable Energy Certificate (REC) products, renewable fuel credits, and now voluntary offsets on TVCM.

The combination of compliance markets and voluntary carbon markets makes increasingly more sense given the evolution of both markets. Sometimes client compliance instruments can be used for voluntary commitments and vice versa. For example, a small percentage of compliance can be met through voluntary offsets via the Western Climate Initiative (WCI).

Flexible functionality

The functionality of Joule has specifically been built out to achieve flexibility when transacting with energy markets. This flexibility is key for the offset market to achieve trade efficiency, both for pre-trade matching and post-trade settlement efficiencies. Whether the trades are executed in a broker market and brought to the venue for processing purposes, or matched through the screen, the aggregation of the market data means there is much more price transparency to the voluntary offset space.

Available through existing Trayport APIs, an optional read-only functionality is provided so that traders can monitor the market.

Aggregated views for transparent pricing

Ultimately, offering environmental markets on proven market platforms is a key to building price transparency and confidence. And TVCM, through Joule, allows traders to obtain an aggregated view of each of these markets with clear and transparent pricing.

A streamlined process in the voluntary offset space will aid these markets in scaling up globally. TVCM goes a long way towards providing that transparency, with a platform that allows traders to better make sustainability-focused investment decisions.