autoTRADER

Trade Spot, IntraDay, and Forwards & Futures with Algorithms

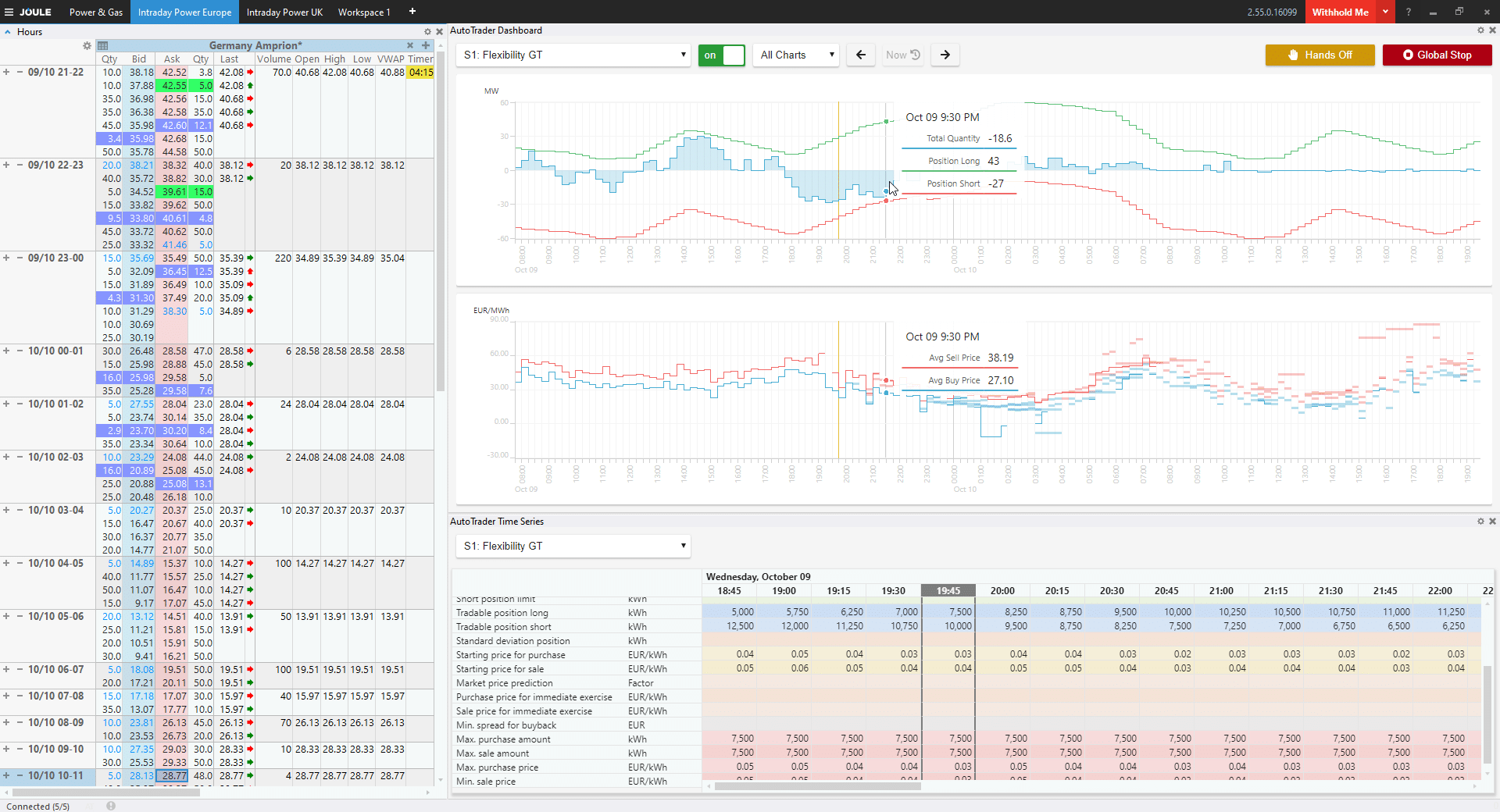

Fully integrated with Joule, autoTRADER is a powerful tool to enable automated short-term power and gas trading on energy exchanges. It can also support forwards and futures trading on Exchanges as well as brokered OTC markets.

Use algorithms to react quickly to changing market conditions, fulfilling your trading targets while limiting or removing the need for manual intervention. Systems that can control your trading process from fully manual to fully automated – the choice is yours.

Including:

Use automated trading tools at night and weekends for 24×7 trading

Select specific scenarios to trigger automated trading

Use automated trading tools for individual assets or portfolios

autoTRADER comes with a range of out-of-the-box algorithms to choose from. These include algorithms for Position Closing, Flexibility Marketing, Storage Optimisation, and Market Arbitrage.

Use our developer tool to create and test your own algorithms using simple python code. Assess the performance of your algorithm by simulating its performance using real-time live market data within a read-only environment.

autoTRADER powers the growth of your business with scalable solutions and a range of options that can be customised to your needs. Our autoTRADER LITE solution is the ideal entry point into further automation allowing you to explore the benefits of using algorithmic automation within your trading activities.

Or explore one of our more comprehensive autoTRADER solutions which include our most advanced full feature option, autoTRADER PRO. The PRO option provides you with a developer tool kit to create your own algorithms plus a REST API to quickly command autoTRADER.

Designed By You | Built By Us.

Developed and designed with our clients for our clients, autoTRADER provides an opportunity for forwards and futures traders to develop their own algorithms using simple python code. autoTRADER is compatible with our Tradesignal and Data Analytics tools for managing your trading triggers. Exclusively for our clients only, we have compiled a whitepaper written in consultation with clients and legal industry experts to make it even easier to understand how autoTRADER helps you to maintain MiFID II compliance when using algorithms to trade forwards and futures.

If you’re interested in autoTRADER, please contact our team using our form or call us on +44 (0) 20 7960 5511. Alternatively, feel free to book a demo session with one of our product specialists or attend one of our upcoming webinars.