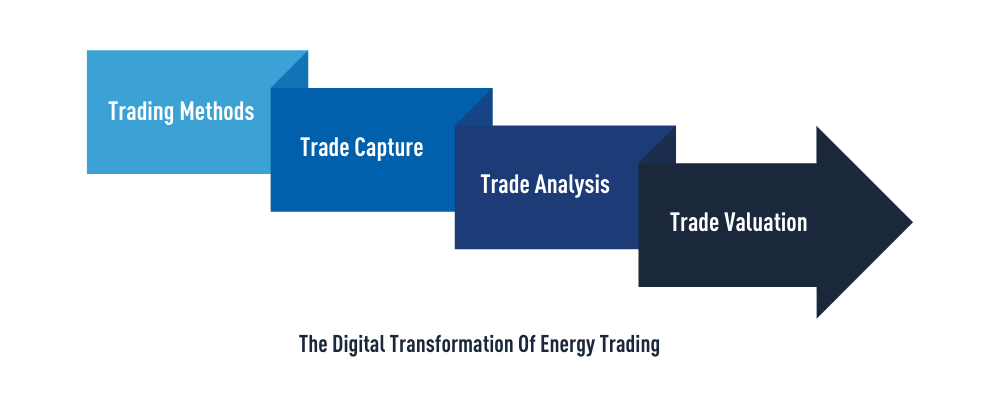

Like most industries, with technological advancement and increased requirements the energy trading industry has evolved and gone through digital transformation. The most recent part of the digitalisation of energy trading comes from the use of algorithms. This has undeniably caused a radical change within energy trading but also comes with a range of requirements in order to be successful.

The History Of Energy Trading Digitalisation

To understand where we are headed with further digitalisation of the energy market, we must first look at how far trading has come.

1. Trading Methods

Since the beginning of energy trading, the trading methods used have progressed from trading via voice to trading screens and today to trading using algorithms to react to market changes faster.

2. Trade Capture

Formerly, trade capture was performed through the laborious process of physically writing trades on a piece of paper and then entering them manually into a trade capture system. Due to technological advances and the increase of trading volume, trade capture transformed into automated csv/xml file exports. Today, APIs are used to communicate trade data between various trading systems.

3. Trade Analysis

Originally most traders used their own Excel tool to analyse and forecast market prices. This has eventually been replaced by sophisticated analytics tools similar to those used in the financial industry but adapted specifically for energy trading. Today we see traders using AI for their trade analysis.

4. Trade Valuation

In the early days of energy trading, companies ran massive Excel macros calculating end-of-day risk metrics. Over time this morphed into highly complex but very efficient Energy Trading and Risk Management systems (ETRMs). Today ETRMs are managed by cloud solutions to ensure peak performance for end-of-day calculations.

The Requirements For Successful Digitalisation With Algorithms

The ability to build and set algorithmic trading strategies in production, and a scalable backtesting framework is a crucial capability to sufficiently test algorithms. An important step for firms looking to achieve a competitive edge is securing capability to develop repeatable processes for the development of algorithmic trading strategies.

To achieve this, sophisticated tools for systems and process integration need to be introduced to cover the whole transformation process – from deriving and designing algorithmic trading strategies, to their implementation via a reusable development framework, backtesting and refining, and the monitoring of execution and calibration of algorithms through KPIs and other measures.

Fortunately, today’s energy trader has a variety of tools to assist in the digital transformation journey. Traders can select a number of front-office solutions such as algorithmic trading systems, data analytics and trading strategy development tools to help develop algorithms and provide access to the historical order book data to use for backtesting.

The deployment of such sophisticated systems in the front office has a profound knock-on impact on other parts of the business, such as middle-office and back-office. An ETRM system ties together front-office business processes with those of middle-office and back-office, and therefore ETRM systems need to manage big-data efficiently. This inevitably leads to running those ETRM systems in a cloud.

The Future of Digital Transformation For Energy Trading

Digital transformation is unavoidable and as time marches on, front, middle and back-office functions will all have to adapt to algorithmic trading in order to increase their levels of real-time performance. It is a matter of being able to efficiently manage big-data in order to ensure completeness, quality, and critically – fast execution.

To support the digital transformation process, Trayport and its third-party providers help increase efficiency in the trading organisations of energy trading clients by increasing the level of automation in trading across the whole spectrum of the trading process. This is done by supplying custom algorithms, developing automated trading strategies tailored specifically for clients, and providing guidance for selecting, designing, implementing and migrating systems on-premise or in the cloud.