We live in an era of digitalisation. Ideally, we should no longer be limited by manual intervention – and this extends to large institutions that operate small utilities or who are wholesale retailers and General Clearing Members (GCMs) trading on energy markets.

Traders continue to face challenges with sales desks and portfolio managers still reliant on a manual process of obtaining a market curve, applying a related pricing structure, and then conveying this to their end customers. This information is sent to their clients using outdated methods such as voice chat groups, emails and even fax. When conveying messages to clients, the sales desk and the portfolio managers constantly have to work on generating these numbers before sending them on; an extremely time-consuming process when completed manually. This time could be much better spent on maintaining relationships with those customers.

Digitising relationships

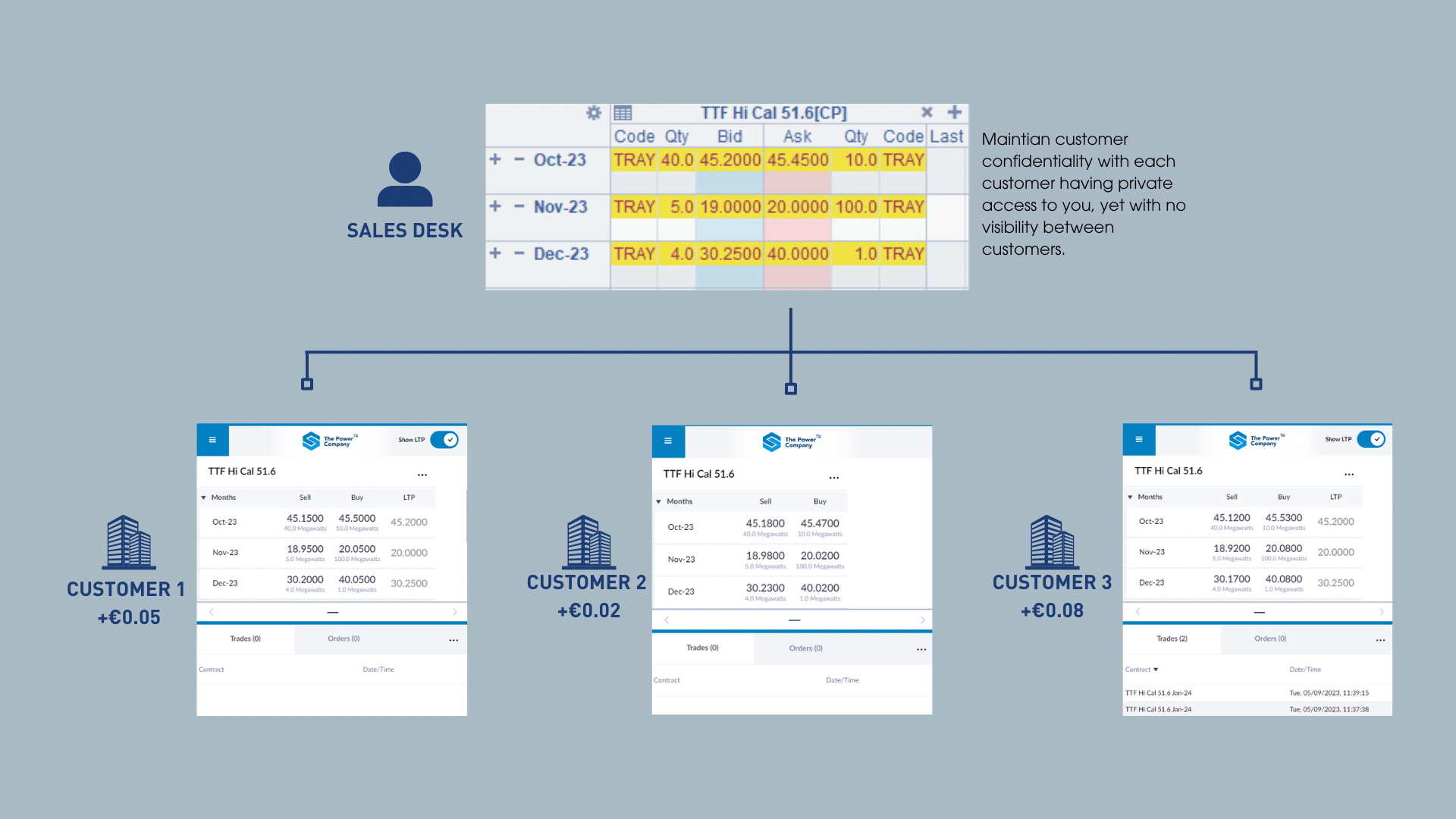

At Trayport, we have automated this manual procedure by introducing a new workflow to allow managers to spend more time on customer relations. Trayport’s Customer Portal is a purpose-designed, customer-facing web portal that allows you to efficiently distribute and receive real-time customer quotes. Our Portal not only enables your front-end clients to engage with your sales desk and your portfolio managers, but it is also a way for brokers to allow customers to participate in the end-to-end experience of the market.

If we look more closely at workflows, the Customer Portal solution has the ability to calculate and distribute the curve in real-time. In effect, this means that the customer portal screen that traders offer to clients will look at the current market of any asset class. Any price or volume update will immediately be visible to the end client, but employees will no longer have to perform the manual task of updating prices and sending them to clients.

Pricing structures can be applied in real-time to all the contracts that end-clients have access to. This net pricing uses Trayport’s pricing engine which is available in the Customer Portal. Net fees are shown to customers on a contract and customer-specific basis, so they can view the net price whilst helping to increase accuracy and minimise their administrative workloads. There are three different tiers of fees administered either per customer, to a group of customers based on asset class or underlying instrument, or per specific contract.

This infrastructure can use an existing API connection to receive all trading activity via Customer Portal for seamless integration with back-office operations. The portal can be accessed from anywhere, including placing orders via mobile phones, tablets or laptops. Traders can access multiple venues along with the additional functionality of charting, order management and order routing. The Portal is a very customisable, web-based solution, which can be white-labelled and even localised for certain languages, including English, German and Italian.

Powerful solution

We live in an era of digitalisation where we no longer have to be limited by manual intervention. Trayport’s Customer Portal solution is an electronic system that can be customised around your individual business case. Essentially, the Customer Portal is a simple, but extremely powerful tool in terms of what it can achieve both for you, and your customers.